Payment trends for 2024 in Latin America, The CPO Playbook, and Brazil Card Payments 2023

Cross-Border E-commerce, Sports Gambling, Real Time Payments, fraud, and others will be the payment trends in 2024. Plus we walk through the day-to-day of a CPO

“If I had asked the public what they wanted, they would have said a faster horse.“ - Henry Ford

Hi Fintech and product enthusiasts, founders, and friends. Today we'll walk through the key payment trends for 2024 in Latin America, and the day-to-day activities of a CPO. In addition, some exciting news such as BTC hitting a new all-time high, Mercado Pago breaking through 51m customers, and more.

💳Payment Trends 2024 in Latin America

Kushki's report on Payments trends in 2024 in Latin America highlights is 🔥

TL'DR

In Latin America, the commerce and payment landscape is poised for further innovation and diversification.

Real-time payment systems are thriving, with governments in the region actively pursuing this technology for their citizens.

Consumers are embracing technological advancements like contactless payments and security authentication.

The anticipated impact of Generative AI on the evolution of new solutions is significant.

Additionally, regulators are increasingly supportive of fair, low-cost, and efficient payment systems, and are advocating for the growth of new digital industries such as online betting

The 2024 payments trends👇🏼

1. Cross-border e-commerce is expected to grow further

2. Real-time Payments are on the rise, though adoption challenges remain

3. Sports betting in Latin America is booming

4. Omnichannel and UX are key to satisfying more complex and sophisticated consumers

5. Fraud will keep getting worse

6. The rise of Gen AI, not only for fraud but also to assist with sales and marketing as well as yield cost reductions and automate tasks across the value chain

et the full report here

📖The CPO Playbook

I recently came across this great article by Agustin Soler, Mural's Co-Founder, where he describes his day-to-day as a CPO. As I aspire to become a CPO in the future, and as many of my readers are product managers and founders, thought it would be helpful to synthesize his summary and share it here as well 👇🏼

CPO Activities: 🧭 Strategy

🔍 Constantly reviewing various sources of insight to inform the product and company strategy.

🗣 Gathering feedback from users and customers through regular interviews and meetings.

📊 Analyzing market trends, assessing the competitive landscape, and staying updated on emerging technologies.

🛠 Evaluating the onboarding experience to enhance it for new users.

🌟 Crafting and updating the product vision and strategy.

🤝 Working with pillar heads on strategy and OKRs.

Some popular product vision statements are👇🏼

“to create innovative technology that is accessible to everyone and that adapts to each person’s needs.” (Microsoft)

“to build a place where people can come to find and discover anything they might want to buy online.” (Amazon)

“to create economic opportunity for every member of the global workforce.” (LinkedIn)

CPO Activities: ⚽️ Team

In terms of team management, the CPO focuses on:

📝 Reviewing and updating career ladders to ensure talent development and growth.

📈 Conducting performance reviews and facilitating promotions and spot bonuses.

🤝 Hiring top talent and ensuring their retention within the organization.

👥 Regular 1:1 meetings with direct reports, skip-level meetings, and office hours to promote open communication and accessibility.

CPO Activities: 🏗️ Execution and Processes

Regarding execution and processes, the CPO oversees:

🔄 Project advancement and participation in product reviews.

📊 OKR and project reviews, providing guidance and feedback.

👥 Leadership meetings and staff meetings to align on priorities and make decisions.

🔧 Collaboration with Product Operations to optimize processes and workflows.

Executive Activities

As a member of the executive team, the CPO prioritizes:

📅 Attendance at executive team staff meetings for strategic discussions and decision-making.

🎓 Conducting onboarding sessions for new team members to familiarize them with the product organization.

🔧 Participation in executive leadership team workshops to address key topics and initiatives.

📊 Monthly business reviews, 1:1 meetings with the CEO, and board meetings to ensure alignment with company goals.

Rituals and Meetings

Various rituals and meetings serve specific purposes and are held at specific cadences:

Product exec reviews: Weekly meetings to address specific challenges and provide strategic direction.

OKR and projects reviews: Monthly sessions for leaders to present updates and receive feedback on OKRs and projects.

Product leadership meetings: Regular gatherings to discuss priorities and make decisions among department heads.

Staff meetings: Weekly updates and discussions to foster collaboration and alignment across teams.

Product manager/design meetings: Bi-weekly meetings for alignment and communication across teams.

Pricing and packaging meetings: Weekly sessions to inform pricing and packaging decisions.

External facing activities: Occasional engagements with external stakeholders to gather insights and enhance relationships.

All Hands meetings: Periodic gatherings for company-wide updates and alignment.

Offsites: Periodic meetings for planning and team bonding.

Peer meetings: Monthly 1:1 sessions with executive peers to share challenges and align on initiatives.

By actively participating in these rituals and meetings, the CPO ensures effective communication, collaboration, and decision-making within the organization, contributing to the overall company success.

🗞️Fintech News and Bites

🚀BTC, to the moon. Bitcoin price went over USD $73,000 💪🏻

🇨🇴 Yuno, a Colombian payments platform, secured a $25 million Series A round, with investments from DST Global Partners, Andreessen Horowitz, Tiger Global, Kaszek Ventures, and Monashees.

🇧🇷 FinanZero, a Brazilian credit marketplace, received $4 million in funding from the Brazilian fund 4Equity.

🇨🇴 Kravata, a Colombian startup providing payments solutions for businesses, raised $3.6 million in a funding round led by Volt Capital, Framework Ventures, and Circle Ventures.

🌎 Metamask, headquartered in San Francisco, expanded its services to Latin America by integrating with the local payment systems of Mexico, Colombia, Peru, Chile, and Argentina.

🇧🇷 The Central Bank of Brazil outlined its regulatory priorities for 2024, which include rural credit open finance, Banking as a Service (BaaS), tokenization, financial assets, artificial intelligence, foreign exchange, and international capital, among others.

📊 MercadoPago achieved a record high of 53.1 million users in Latin America, marking a 20% year-over-year growth. Mercado Pago's revenues now contribute over 40% of total Mercado Libre's revenue, narrowing the gap with the e-commerce business unit's outcomes.

💳 Vivo applied for a Direct Credit License with the Brazilian central bank. Read more about it here.

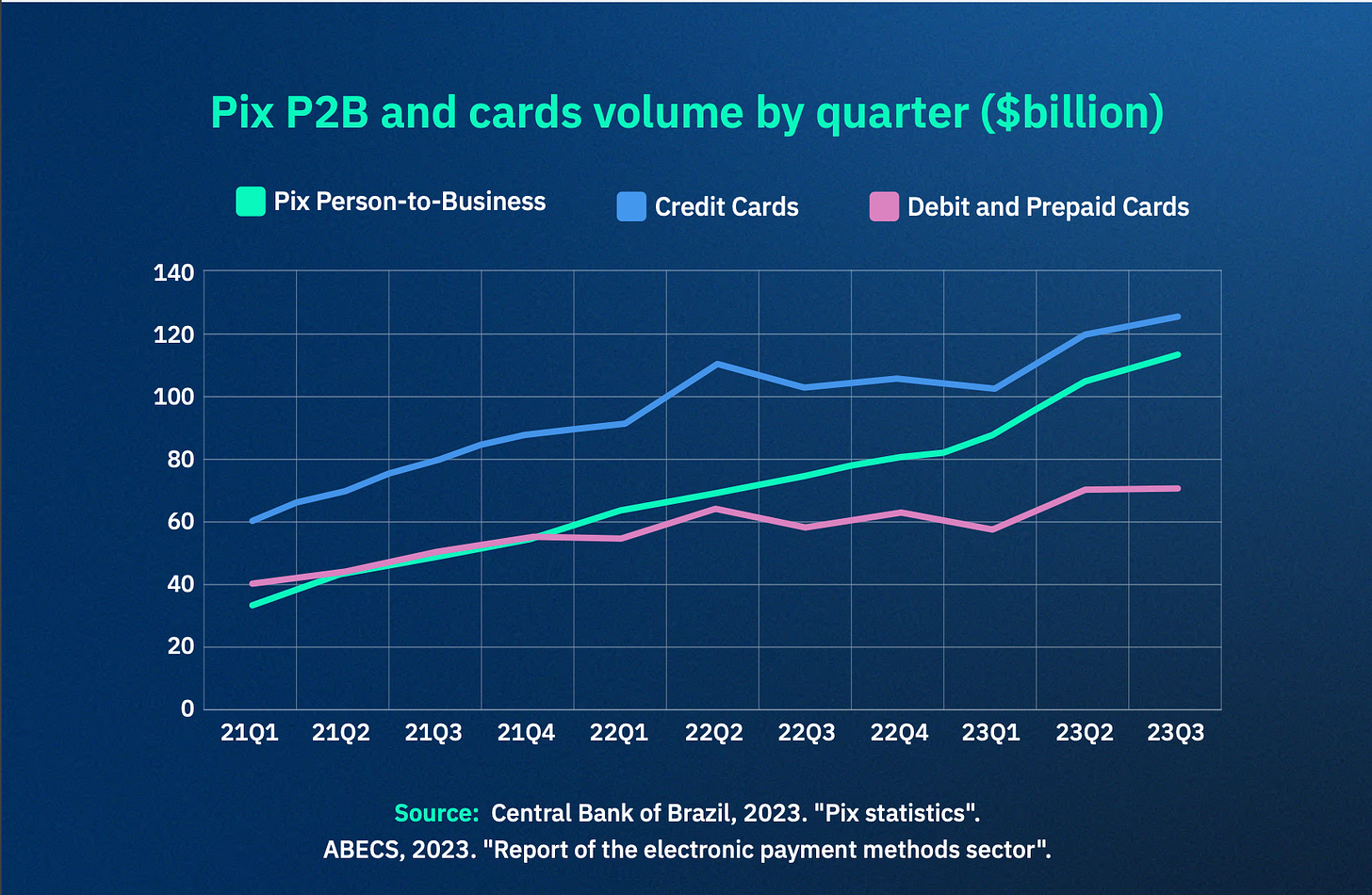

🇧🇷 Brazilian card payments totaled R$ 3.73 trillion in 2023. Read the full report here, or the TL'DR below

🌐 BRICS countries are collaborating to develop a digital currency for real-time cross-border payments.

💳 Google Play now accepts PIX as a payment method.

💸 PIX reached a new record with over 179 million daily transactions.

📈 The annual Brazilian credit card revolving interest rate decreased to 415% per year.

💳 Banco do Brasil is set to commence testing offline payments with DREX.

🇧🇷 Brazil has over 1.2 billion open bank accounts.

Brazilian Card Payments Deep Dive

Brazilian Abecs just released Brazil's card payments 2023 report, and the numbers are 🔥.

TL'DR

💪🏻Credit Cards are the preferred payment method, and TPV grew by 10%. While prepaid cards have the highest growth, they still represent just 8% of total volume.

🌎 Cross-border payments show high growth, fueled by an increase in travel and tourism spend

🛜 Chip and PIN are dying: NFC payments are dominating payment methods and digital wallets and e-commerce have shown explosive growth

🚨Delinquency is starting to go down, but it's still high. The Brazilian Central already implemented a cap on revolving debt in late December, but it hasn't shown great results. More discussions and actions are expected to take place.

🎠Full Takeaways🎠

🚀 Total cards volume increased by 10% YoY, totaling R$3.7 trillion in volume

--> Factors that pushed this:

💫 e-commerce growth

👷🏻 unemployment hitting the lowest rate since 2014 (7,8%)

🛵 services growing by 2.3%

💵 family's income growing 6.5%

💳 Credit Card payment volume increased by 12%, representing 64% of total card payment volume.

💵 Debit remained flat with a 0.1% decrease and a total of R$1 trillion

🐖 Prepaid cards grew by 34% YoY, though they represent 8% of total volume'

🔥 On average, there were 115 million card transactions per day in 2023, with a total of 42.2 billion card transactions (13% growth)

--> Average credit card transaction volume: R$135

--> Average debit card transaction volume: R$61

--> Average prepaid card transaction volume: R$40

💎 Corporate card transactions grew by 12% totaling R$282 billion, though they represent 8% of total payment volume

📚 Groceries, Airline tickets, and tourism are the top 3 sectors with the highest growth in terms of volume

🌎 Card Cross-border transactions increased by 38.4% YoY totaling R$66 billion, beating pre-pandemic levels. led by Europe, US, and America excl. US

🛜 Online and digital wallet transactions increased 13% YoY, totaling R$830 billion. Credit Card payments correspond to 96% of total volume.

🤖 NFC payments are over 26% of total card transactions: they increased by 70% 🤯, totaling R$986 billion, and the number of transactions increased by 60%.

---> Over 54% of card-present transactions are via NFC 🔥

😰 Although credit card revolving debt represents just 2.4% of total families' debt, Credit card delinquency is at 7.5%. Delinquency is showing a downward trend.

Impressive growth for the card payments sector in Brazil. Companies with large card customer bases will greatly improve their results if they can control delinquency. A good example of this has been Nubank, which has shown great results over the past quarters despite hyper-growth in its customer base.

That was all! ✌🏼

Thank you for reading my newsletter! If you enjoyed it, please subscribe and share it with your friends and colleagues.

Un Abrazo,

Edu