Global Fintech Trends, Building Products from Zero to One, and Latest LatAm Fintech Trends

Reflections from the past weeks, global fintech trends for 2025, and how to hack building products from scratch from the best out there

Reflections from the Trenches 🧠

A few takeaways after a couple of weeks of travel, sunsets, and some well-needed space to think.

1. Self Check-In > Optimization

The definition of a "relaxing vacation" shifts with time. There was a time when hitting 5 cities in 10 days felt like fuel. Now? It’s a fast track to exhaustion.

Check in with yourself. Be honest. What fills you up now might not be what it was three years ago, and that’s OK.

2. High-Performing Teams Thrive Without You (If You Let Them)

I unplugged for a few days, and the team didn’t just hold the line; they pushed things forward.

That only works when you invest upfront: Clear direction, context, aligned incentives, and room to execute.

It’s also a powerful reminder: disconnecting doesn’t mean disappearing. You can be present when needed, without checking every Slack ping.

Empowered teams become a superpower. Invest in them.

3. Loving Your Work Isn’t a Red Flag

I found myself checking e-mails on vacation, not out of stress, but curiosity.

“What did the team ship today?”

“What’s that deck looking like?”

“Did we get that reply?”Turns out: this isn’t a bad thing. It means you care. It means you enjoy the game.

Look for roles where opening your inbox feels exciting, not anxiety-inducing.

4. Pay the Ticket, Enjoy the Sunset

Got a €60 parking ticket in Greece. Classic tourist move. Was annoyed for 10 minutes… then I reframed it:

Would I rather spend 30 minutes walking up a steep hill in the heat, or pay €60 and watch the sunset for longer?. Easy answer. It reminded me of something Naval once said:

"If you can outsource something for less than your hourly rate, you should." — Naval Ravikant

Sometimes the price of peace is worth it.

And when things go wrong, remember:

“Choose not to be harmed — and you won’t feel harmed. Don’t feel harmed — and you haven’t been.” - Marcus Aurelius

Perception is everything.

Control what you can. Accept what you can’t. Enjoy the damn view.

5. Own Your Fate, Be a Multiplier

Change is constant in high-growth environments. The edge comes from those who reposition fast and create value before being asked.

Influence doesn’t come from titles: it comes from solving relevant, high-leverage problems.

Roles aren’t handed out: they’re built by those who combine vision with execution. Become a multiplier. Own your fate.

Global Fintech Trends: What Comes After the Hype

The fintech hype cycle is over. But the opportunity? Bigger than ever.

BCG and QED just dropped their 2025 Global Fintech Report. it’s a banger. I’ve pulled together the sharpest insights so you don’t have to wade through 50 pages.

Here’s the playbook for what’s working, what’s next, and where the smart money (and teams) are heading:

📥 Download the full report here 📊 Co-authored by BCG + QED, based on interviews with 60+ fintech execs and investors

1. Entering a New Chapter: Profitability Beats Scale

Revenue growth rebounded to 21% in 2024 (vs. 13% in 2023).

The market is shifting from “growth at all costs” to “sustainable, profitable growth.”

EBITDA margins improved 25%, with 69% of public fintechs now profitable.

Only 3% of global banking & insurance revenues have been penetrated—massive upside remains

2. Fintech Is Only 3% In — And Growing 3x Faster Than Banks

Yes, fintech has barely scratched the surface:

Just 3% of global banking and insurance revenue is penetrated.

But it's growing 3x faster than incumbents.

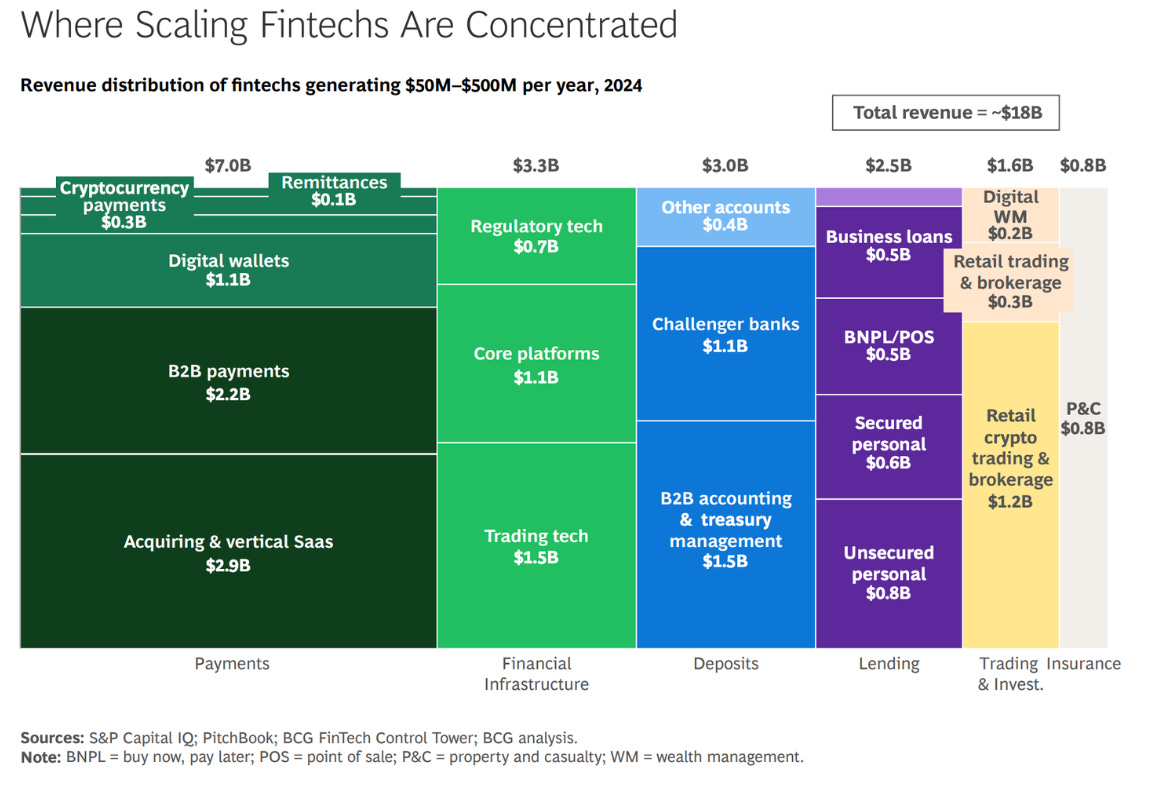

~100 scaled fintechs (those with $500M+ in annual revenue) make up 60% of all industry revenue.

Success is concentrated in:

Digital wallets

Acquiring & vertical SaaS

Challenger banks (e.g., Nubank, Monzo)

Retail crypto trading

BNPL/POS lending

Payments dominate with $126B of the $231B in scaled fintech revenues.

Verticals like insurance, wealth management, and secured lending are still <1% penetrated.

It's still Day 1.

3. The winners so far are where banks were:

Too slow (→ vertical SaaS + modern acquirers)

Too exclusionary (→ challenger banks + BNPL)

Too constrained (→ wallets + crypto)

4. Geographic Penetration Gaps: US & China Dominate in Revenue Share

US & China = 68% of scaled revenues

Latin America (~10%): shows strength via Nubank, Mercado Pago, and others.

MEA & Europe still have significant underpenetrated segments.

US: 52% (~$120 billion) of scaled revenues, due to its large addressable market and easy access to capital. Digital wallet players and acquirers have benefited from a highly consumer-driven market (particularly in e-commerce) and a card-first economy in which both consumers and merchants prioritize seamless acceptance

China: 16% (~$38 billion) of scaled fintech revenues, with success also driven by a large addressable market in addition to the rise of “super apps” like WeChat and AliPay

Europe: 8% (~$19 billion) of scaled fintech revenues. The region’s heterogeneity and regulatory regimes have made scaling difficult. Nonetheless, challenger banks (for e.g.Revolut, Starling, and Monzo), remittances (e.g., Wise), and BNPL/POS (for e.g., Klarna, SumUp) have led the charge in Europe by catering to younger consumers seeking superior digital experiences and low foreign exchange fees for traveling. As I got back from my vacations in Europe, it was incredible to see small merchants everywhere using SumUp, Revolut and Monzo card-holders, Contactless payments at every toll and public transportation, even ATMs. Still room for growth IMO.

APAC (excluding China): 10% (~$22 billion), driven by super apps in their home markets (e.g. Grab, Toss, PayTM, PhonePe, and GCash, ZaloPay, Timo) success. The heterogeneity of Asia-Pacific, similarly to Europe, makes scaling across borders difficult. Large markets like India growing rapidly in terms of population, economic growth, and tech adoption, can bring exponential growth over the next years.

LaTAm💜: 10% (~$22 billion), with Nubank, Mercado Libre, and others succeeding by targeting large un- and underbanked populations, leveraging growth in the retail sector, and government-driven financial inclusion policies and innovation (Real Time Payments (PIX in Brazil, Bre-b in Colombia), Open Finance, Fintech Laws, etc.)

Middle East and Africa: < 1% (~$3 billion). Fintechs serving the needs of un- and underbanked consumers through mobile are seeing rapid growth in penetration, with Telcos having formed some of the most successful fintech platforms (e.g. M-Pesa). I've been syncing with peers in Dubai and the Middle East, and you should expect big innovation and higher penetration of fintech and tech platforms over the next 24 months (attracting great talent, investing significantly, regulators making the right moves)

5. Future Fintech Trends

1️⃣Agentic AI Will Eat Fintech’s Stack (Eventually)

Everyone’s playing with GenAI. But the next wave, agentic AI, will be far more disruptive.

Think self-operating agents that research, reason, and execute.

Most fintechs are in pilot phase. Early-stage ones are using it for coding + speed.

Long-term: massive potential in commerce, personal finance, and SaaS automation.

Early advantage: Younger players building AI-native infra from day one.

2️⃣ Onchain Finance = Real, but Misunderstood

Crypto may have cooled, but onchain infrastructure is heating up:

Asset tokenization is the next big play (real estate, private funds, bonds).

Cross-border stablecoins are the obvious entry — but infra + standards still lag.

Big banks are already piloting scalable use cases. But still early.

Transitioning from pilot projects to large-scale deployments in on-chain depends on: enhanced regulatory clarity, unified standards, bank-grade infrastructure, and a critical mass of early adopters for network effects to take root.

💡 Think of it as the fintech version of cloud circa 2010. Not mass-market yet, but inevitable.

3️⃣ Fintech Strategy: Product and Customer Segment Expansion Have Higher Odds of Success Than Going Global

Winning strategy before: go global, acquire as many customers as possible, high CAC, cashback, go for everybody, 1mn users = 1bn valuation.

Winning strategy now: deepen relationships and diversify revenue streams

Diversify beyond fee income

Grow average deposit balances

Affluent user segments

Product expansion (loans, investments, insurance - hit me up for insurance 🔥)

Expand into new geographic markets (be picky)

🛑 Going global: high risk, low return (unless you're Mercado Pago or Nu). Instead, pick a few core markets where you can get a competitive edge and where traditional banks are lacking.

4️⃣ Lending: The $280B White Space No One Talks About

Fintechs have originated $500B in loans — sounds big?

Compare that to $18T in US household debt alone. It’s a rounding error.

Outside of personal unsecured consumer lending, fintech penetration remains less than 1% in other domains such as secured loans and business loans.

🔥 What’s changing:

Better underwriting + data

Risk scoring third-party providers accelerate time to market: no need to build your own credit scoring team from zero to one

Private credit funds entering strong (with $1.7T in AUM)

Players with massive customer bases and better ML models have a huge competitive advantage

Est. $280B white space for fintech-originated loans backed by private credit over the next few years: partnering with fintechs, which now originate billions of dollars in loans every year, represents one such attractive opportunity for private credit funds

But be warned: this model hasn’t been tested through a full credit cycle yet.

5️⃣ Where the Next Scaled Winners Will Come From

Forget launching another wallet or BNPL clone. The future lies in:

✅ B2B(2X): Embedding fintech inside SaaS to solve real pain points (payments, accounting, treasury)

✅ Financial Infrastructure: Long sales cycles, yes — but massive upside modernizing old rails

✅ Lending: Especially SMB and secured lending where banks are slow, manual, or blind

Final Thought: The Next Fintech Boom Will Look Nothing Like the Last One

If the first wave was “consumer-first,” the next one will be:

Infra-first

AI-native

Painkiller > Vitamin

And you won’t need 100 million users to be a unicorn. Just one killer wedge in a $13T industry.

Launching Products from Zero to One: Hacks from the Best in the Industry

Whether you’re a founder, an operator, or a product leader inside a scaled company, building a new product from scratch is never easy. No roadmap. No traction. Just ambiguity, high pressure, and the need to create momentum where there’s none.

I’ve been through it myself: from launching a "pay with crypto" card, to building a BNPL-style credit card in-app experience, to launching a full banking stack for SMEs. Each one taught me that zero-to-one is a muscle, and the best way to build it is to learn from others who’ve done it well.

That’s why I’ve pulled together the sharpest insights from three of the best product minds in the game (link in comments):

Mihika Kapoor – Product @ Figma

Tanguy Crusson – Product Lead, Jira Product Discovery

Uday Marepalli – Product @ Upwork

Here’s what they taught us:

Why Big Companies Struggle to Launch New Products 🚨

Tanguy: "The company has a tendency to over-invest. Startups have the benefit of starving. So you need to create scarcity."

Too many resources, too early, creates pressure to scale before the product is ready. Success starts by deliberately limiting scope and visibility so the team can learn without interference.

When building a BNPL product in Mexico, we had a pack of 2 Back End Engineers, 2 Front End, a shared Product Designer, and tried to recycle as much as possible of other financing services the company had. This ensured that is was seen as a high ROI bet and allowing us to focus on building vs constantly fighting for resources.

Be clear on “Why Now?” 💧

Tanguy: “We had to be very clear with stakeholders: Why are we doing this now? What’s changed in the world that makes this urgent?”

“Why now” helps filtering ideas, prioritize experiments, and pitch the story internally. All new product ideas need to me framed around company strategy shifts or external change; not just “good ideas.” How does the new feature or product will help our company achieve their strategic objectives? Why, if successful, will it be stronger than other bets prioritized?

The Why Now question is also a great weapon against top-down shiny and bright ideas that are not backed by data. You need to protect your scope, else someone else is going to occupy that space.

Everyone’s a PM 👥

Great products run on collaboration, not handoff.

Engineers attend design syncs and contribute from day one.

PMs, designers, and engineers jam together live in the product.

Research isn’t siloed: everyone joins calls, asks questions, and does outreach.

Defense, platform, and enabling teams (Legal, Compliance, Risk, Ops, Finance, Fraud, etc.) should be involved in the project from the start

Mihika Kapoor💡 “One of the most fascinating things I’ve seen: when a team hears a user say something directly, they’re 100x more likely to act on it.”

At the best companies I´ve worked on, the UX researcher invited all of the team members (design, data, eng, CX) to join the primary research interviews. This helped us build the best-in-class products.

Start Ugly, Stay Scrappy: Prototypes > PRDs 🔥

Mihika: "If I had written a PRD for every idea we explored for Figma Slides, I’d still be writing those docs."

Tanguy: "The first thing we shipped was a list of text fields. We just wanted to see if teams would manually enter insights."

Prototype instead of writing.

Ship placeholder experiences.

Don’t obsess over polish. Instead, obsess over validating behavior.

PMs should prototype too using AI tools to get ideas off the ground faster.

When we launched an SME banking acount for SMEs the original dashboard didn´t even have filters to order by date. We kept it simple, shipped, and iterated fast to get to the final flashy design. We did a silent release first, then scaled.

How Frequent Feedback Loops Accelerate Product Learning 🔄

Mihika: “There’s no team that can tell you exactly what to do. There’s no customer that can tell you exactly what to do. You have to build your own user lens.”

Tanguy: "We gave updates every month: what we learned, what changed, what we’re trying next."

Uday: "Customer feedback is gold, but always think about the context."

Something most PMs get wrong is that you need both internal and external feedback loops to get the best launch

Internal Feeback builds trust through visibility.

Internal storytelling. Fast iteration. Public demos. These leaders used learning velocity as the core metric early on. This will help with buy-in and unblocking dependencies with other stakeholders or teams. Get them excited! = )

External Feedback builds confidence through customer´s feedback

Customer interviews, Prototybe A/B testing, Surveys, etc.

My experience: When launching a Card from zero to one we launched a waitlist without even beginning to write a line of code of the actual card product. In one week we had over 40,000 people in the waitlist who we then interviewed and incorporated their feedback into our core value proposition.

Something that worked across companies was finding core users that would be willing to test your features and give real feedback. We would invite them to select groups, let them know they are beta testers, and then invite them to interviews with us.

Define Hypotheses and Guardrails Early🧪

Tanguy: "We were explicit from the start about our guardrails. If this doesn’t happen, we stop."

Uday: "Start with a clear problem,not a solution. Iterate if execution is off. Pivot if the problem is unclear."

Know what you’re trying to learn, and what would make you kill the product. That clarity gives autonomy and earns trust.

On the BNPL feature we knew from customer research that Mexicans love to finance their purchases. They hypothesis we wanted to test and learn is that people would be willing to go to the app AFTER making the a purchase and finance it. Would the love of financing overcome the friction of entering the app post- physical card purchase? A/B testing with prototypes first gave us the validation we needed to keep investing in the bet.

🧱 Don’t Scale Until It Hurts

Uday: "Retention is a lag metric. Look at satisfaction, iteration speed, and repeat usage."

Tanguy: "You want to bring no one from the rest of the company with you on day one."

Success is not revenue. It’s momentum. Don’t scale before you’ve nailed the core loop.

At all companies I´ve worked at we´ve created syncs, Business Analyst Led, in which all the team, engineers, Designers, product, Ops, would look at our key success metrics, customer feedback and draft hypothesis. We would discuss what is working, what is not, and next steps. This allows the team to go from bug-fixing only focus to building something customers will love.

Go-to-Market (GTM) Strategy Starts on Day One 📣

Mihika: "We didn’t start with a blog post. We launched and let people find it."

Tanguy: "We launched a waitlist with no product. 3,000 people signed up in two weeks."

Uday: "Label every new thing a beta. It buys time and protects trust."

Create internal hype, external signal, and clear expectations. The best GTM starts before the product is ready.

In all companies I´ve worked with, we invited the marketing team to join us from day one to start framing positioning, narrative, and how would a press-release would look like (Amazon press-release model) once the product or feature would go out.

Participating and presenting the product we are building (even at discovery phase) at an all hands meeting at the start of a project builds momentum and motivates the team.

How Team Culture Accelerates Product Launches 🤝

“One of the most underrated things is a team that has worked together before and trusts each other [...] We had inside jokes, custom Slack emojis, a red carpet launch day. The more irrational the name, the stronger the buy-in."

Build belief, not just alignment. A team that laughs together ships faster.

I´ve had different flavors of this at different companies. During the pandemic we would have virtual happy hours, where we would play some Skribbl.io game (pictionary) online. The company would provide a uber eats voucher to get some food and beverage and we would hop in as a team.

When building the SME banking account, it was at a remote-first company. To build culture and momentum we set up a monthly 3-day in person meeting to accelerate the projects momentum and had a happy hour each time we met.

At the card product, the week before beta launch we all traveled to Mexico and worked hard until launch, finalizing with a nice dinner to celebrate the launch.

Key Lessons for Building Zero-to-One Products 🧠

You don’t need a perfect plan: you need traction, clarity, and conviction.

The best zero-to-one PMs don’t chase consensus. They chase learning. They don’t scale noise. They scale signals. And they don’t wait for permission: they build momentum until no one can ignore them.

If you’re building something new? Start small. Learn fast. Stay loud.

And remember: no one argues with a high-speed train.

Sources:

Melissa Perri: https://www.produxlabs.com/product-thinking-blog/episode-206-uday-marepalli-zero-to-one

LatAm Fintech News and Highlights

Executive Summary

The past few weeks in Latin American fintech have been nothing short of packed. AI-powered infrastructure, embedded crypto, and cross-border payments continue to attract early-stage capital, while M&A remains a key vehicle for expansion across the region. Legacy players like BTG and BCI are betting big on digital transformation, while startups like Dex, Conduit, and Cobre are laying foundational rails for new financial paradigms.

On the regulatory front, multiple LatAm markets have introduced new standards for digital payments, tokenization, and salary disbursements, pointing to a region that's rapidly maturing across both public and private fronts. Central Banks concerns around AI are rising. Regulatory changes are expected soon to address their concerns.

Fintech is shifting from experimentation to consolidation and infrastructure, and the players doubling down now will define the next decade.

💸 Fundraising & Debt Deals

Funding is heating up again, with debt becoming the largest source of funding. Brazil continues to lead with large receivables-backed deals and credit infrastructure plays, while cross-border and AI-driven fintechs are securing fresh capital to scale across LatAm.

🚀 Product Launches & Partnerships

AI is going mainstream, both in user experience, infrastructure, and scoring models. Financial superapps are doubling down on AI to improve user service and financial literacy, while B2B players are racing to improve real-time payments, cross-border rails, and merchant tools.

B2C

🇲🇽 DiDi México introduced a high-yield Sofipo-backed account with 15% annual return.

🇦🇷 Ualá added Google Wallet support, enabling contactless Android payments.

🇦🇷 Evertec rolled out Google Pay and Colombia’s new “Bre-B” instant payment button via Placetopay.

🇧🇷 Itaú expands pilot of WhatsApp-enabled Pix payments, aiming for 2M users.

🇲🇽 Hey Banco reported that AI tool “Havi” now manages 40% of client interactions.

🇨🇴 Dale! debuted Apple Pay support for Colombian users.

🇧🇷 Nomad now prints debit cards instantly at São Paulo’s international airport.

🇧🇷 Nubank unveiled “Pagamento Flash” to simplify bill payments in-app.

🇵🇪 ProntoPaga integrated Yape One Click and subscription features in one API for easier merchant billing.

🇩🇴 Qik launched a savings-focused banking tool to boost financial inclusion.

🌎 EthicHub launched crypto-based, collateral-free lending for unbanked farmers in India, Peru, and the Philippines.

B2B

🇧🇷 Conduit partnered with Braza Group to offer real-time FX swaps via stablecoins.

🇲🇽 Muney App allows Venezuelan recipients to cash out remittances in USD at local stores.

🇲🇽 Bitso launched access to SPEI and recurring payments for business clients.

🇧🇷 Conta Simples teamed up with Airwallex to offer IOF-free multi-currency accounts under “Conta Simples Global.”

🇲🇽 Círculo de Crédito integrated T1Score — a credit scoring system using mobile behavioral data.

🌎 Mantra + Win Investments partnered to tokenize sports-related assets using blockchain rails.

🇺🇾 dLocal + BVNK partnered to accelerate stablecoin-based settlements.

🇨🇴 Cobre + Cabify launched instant payouts for 150,000 drivers in Colombia.

🇦🇷 Mercado Pago launched Point Tap — enabling merchants and professionals to accept contactless payments via Android smartphones.

Policy & Regulatory Updates

📑 A regulatory wave is sweeping across LatAm, with national bodies fast-tracking digital payments and open banking frameworks. From recurring Pix to wallet salary deposits, governments are playing offense in financial innovation.

🇲🇽 Finco Pay approved to operate as an IFPE by CNBV.

🇧🇷 Mêntore received approval to issue electronic money from Brazil’s Central Bank.

🇵🇪 New legislation permits salaries to be paid directly into e-wallets (Yape, Plin), subject to mutual agreement.

🇨🇱 Chile rolled out minimum requirements for e-payment security and registration, effective August 2025.

🇦🇷 Argentina's Central Bank mandated higher reserve requirements for mutual funds — likely impacting wallet yields.

🇵🇾 Paraguay's fintech chamber endorsed a national payments law formalizing mobile and digital payment infrastructure.

🇦🇷 Argentina's CNV is exploring tokenization frameworks to enhance capital markets liquidity and participation.

🇧🇷 Pix Automático went live — recurring debit within Pix now fully enabled, especially for SMEs.

🇧🇷 Brazil updated Open Finance UX standards with version 8.0, boosting trust and transparency.

🇲🇽 CNBV cautioned against AI-related cyber risks as the sector evolves.

🇧🇷 CVM warned that AI demands urgent but balanced regulatory attention.

🇧🇷 Swap approved by BCB to operate in Pix Direto, expanding its B2B infrastructure offerings.

M&A

📉 Consolidation is alive and well — with large banks, cross-border platforms, and SaaS providers acquiring infrastructure and client portfolios to accelerate product launches and market access.

🇺🇾 dLocal to acquire AZA Finance, a remittance platform in Africa, to expand payout reach.

🇨🇴 Topaz bought Valid’s financial transactions arm, enhancing its processing capabilities in Colombia.

🇧🇷 BTG Pactual acquired Justa to beef up its corporate payment offering.

🇧🇷 Afinz acquired D3 Pagamentos to launch “Afinz Empresas,” a new SMB product suite.

🇦🇷 Tiendanube acquired VICI (AI commerce) and rolled it into “Nuvem Chat” for 160k merchants.

🇨🇴 Rapyd completed its acquisition of PayU’s LatAm ops, deepening regional coverage.

🇵🇪 NovoPayment acquired Servitebca, solidifying its Peru infrastructure for embedded finance.

🇨🇱 Integrity Holding acquired Alaga, expanding SME lending in Peru.

🇲🇽 Tapi acquired Arcus, Mastercard’s bill pay platform in Mexico, to strengthen B2B payments.

Venture Funds

🧠 Capital is flowing into AI, fintech infra, and founder-led early-stage vehicles — a sign that conviction is returning across institutional and local LPs.

🌎 Plug and Play launched a $50M fund targeting AI and fintech across Latin America. (Shoutout to Eugenio G. de Peña!)

🇨🇱 BCI Bank announced a massive $750M fund to back 20,000 early-stage ventures in Chile.

🌎 Lotux Ventures closed its second fund, offering $50–$100k tickets for pre-seed and seed startups in fintech, SaaS, AI, and marketplaces.

🇲🇽 Coparmex CDMX launched a Business AI Tool and proposed a city-wide innovation fund to boost SME digitization and entrepreneurship.

That’s a Wrap!

That’s all for this edition! Thanks for joining me every week. Your support means a ton. If you enjoyed the insights, consider subscribing to get future roundups on fintech innovation, product launches, and market shifts across Latin America.