Brazil’s Card Revolution, How to Communicate Hard News Effectivelty, and Top Fintech Trends You Can’t Miss

Brazil Card Payment Trends, Dealing effectively with hard news, and fintech industry insights. Bonus: a pic of my dog enjoying life 🚀

Hola Madrid 🇪🇸

I'm in Madrid this week. Let me know if you are around and want to grab a coffee to learn more about how embedded insurance can help grow your business and protect your customers, talk about product, or just say hi.

Brazilian Card Payment Trends Q3 2024

ABEC's Q3 payments’ report is out. All you need to know:

1. Electronic Payments Reach Historic Highs

The value of transactions through card payment methods hit R$1 trillion for the first time in the third quarter (+10.2% YoY).

Credit cards accounted for R$693.2 billion, followed by debit cards with R$248.3 billion, and prepaid cards at R$94.1 billion.

2. Growth in Contactless Payments

Contactless payment volume reached R$376 billion, growing 46.5% YoY.

65% of in-person purchases are now made via contactless methods, with expectations to hit 70% by mid-2025.

Key drivers include convenience and speed, with 89% of users citing these as main benefits.

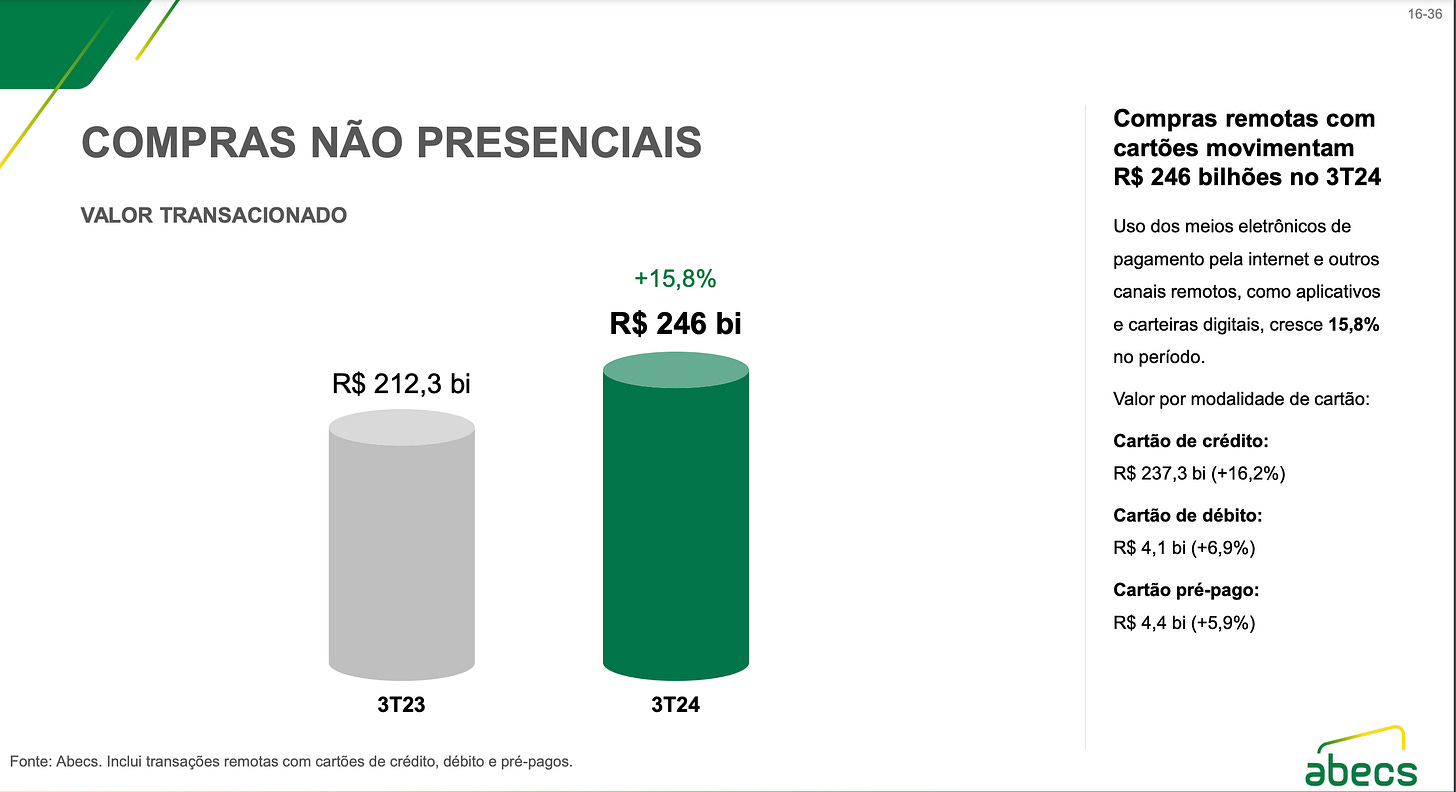

3. Surge in Remote Purchases

Remote transactions (e-commerce and app-based) rose 15.8% YoY, totaling R$246 billion.

Credit cards dominated this segment, contributing R$237.3 billion, followed by debit cards (R$4.1 billion) and prepaid cards (R$4.4 billion).

4. Recurring Payments Gain Traction

Recurring payment transactions reached R$28 billion (+41.2% YoY).

Credit cards remain the primary mode, with an average ticket size of R$85.67.

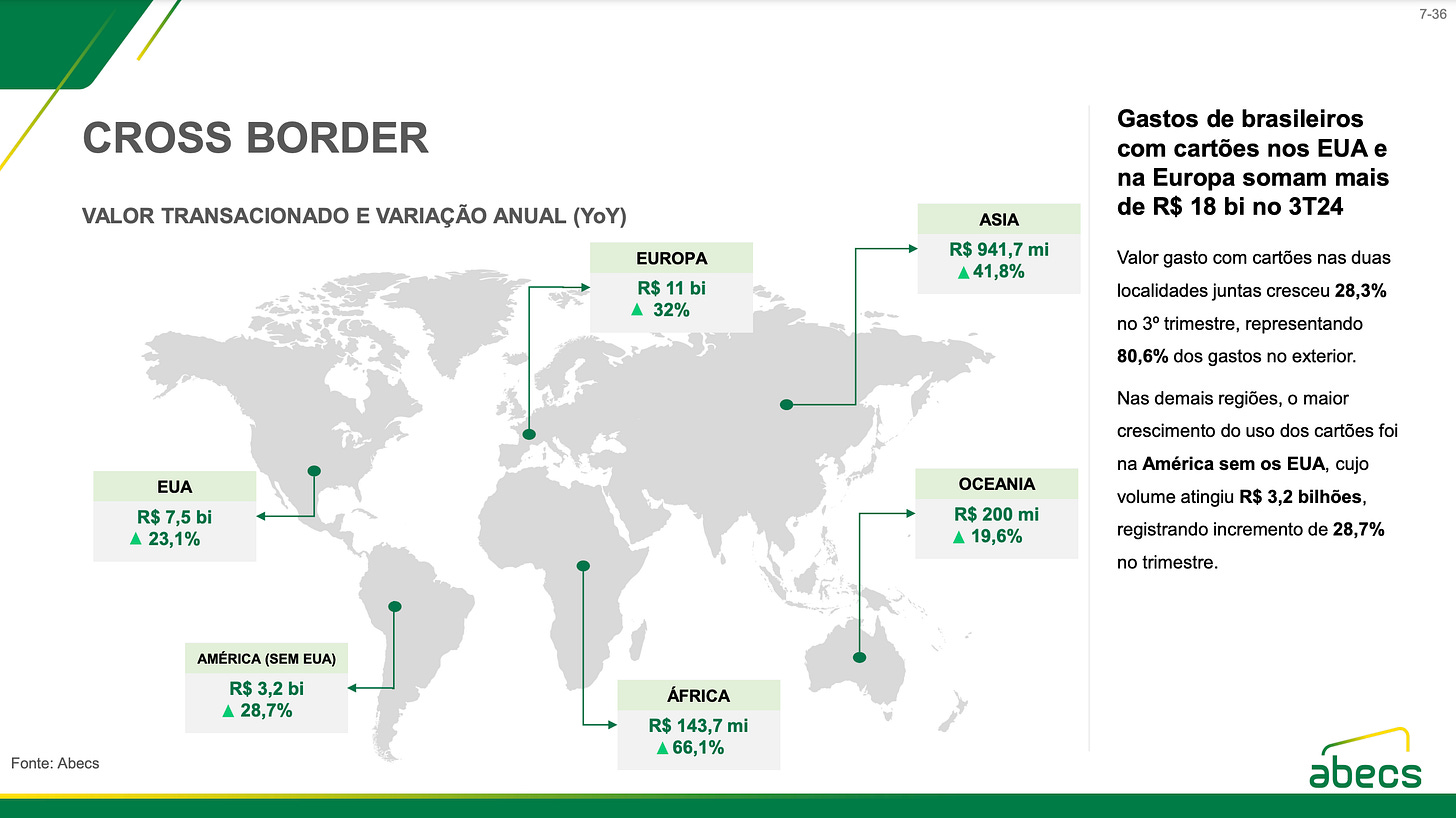

5. Cross-Border Transactions

Brazilians spent US$4.1 billion abroad in Q3 2024, growing 13.4% YoY.

The U.S. and Europe combined accounted for 80.6% of cross-border spending, with significant growth in Asia (+41.8%) and Africa (+66.1%).

6. Sectoral and Regional Highlights

Top Sectors for Card Growth: Pet care (+15%), personal services (+10.3%), and telecom (+13.5%).

On Pet Care, I was part of this growth. Here is Dante, my dog, enjoying his vacation at a pet-only resort in Brazil:

Regional Performance:

Southeast: R$559.5 billion (+10.2% YoY)

South: R$147.1 billion (+16.5% YoY)

Northeast: R$124.4 billion (+12.6% YoY)

Welcome Back, Amigos!

This week has been a whirlwind of insights and milestones. From the staggering growth of Brazil’s card payment ecosystem hitting R$1 trillion for the first time to game-changing trends in fintech funding and innovation, it’s been nothing short of inspiring.

In this edition, I’ll share personal lessons from my journey as a Tech Leader—reflecting on how to effectively communicate hard news to your team while keeping morale and momentum intact. Whether it’s a shift in priorities, strategy changes, or setbacks, your approach as a leader makes all the difference.

And of course, we’ll dive into the latest highlights:

Brazil’s booming card payment trends from Abecs’ Q3 report.

Strategies to communicate with clarity and empathy during challenging times.

Fintech funding and innovations reshaping Latin America's finances.

As always, these updates reflect my personal views and experiences only. This newsletter is my creative space to learn, share, and grow—and I’m thrilled to have you along for the journey. Let’s keep building together!

Navigating Change: How to Communicate Difficult News Effectively

During my career, I’ve encountered moments when difficult news had to be shared with a team—whether it was a shift in priorities, setbacks, or structural changes. At a previous company, for instance, we had to pivot mid-year due to external market pressures, and the way we communicated the changes made all the difference.

Those experiences taught me some invaluable lessons about leadership and the power of effective communication in tough situations. Here’s what I’ve learned from navigating those moments and how they shaped my approach.

1. Align Your Strategic Vision First

Before sharing any updates, ensuring alignment across leadership was crucial. One time, we faced a major project delay on a new product vertical we were launching, and getting everyone on the same page about the reasons, next steps, and core messaging helped us maintain trust and consistency.

💡 Pro Tip: Tailor the message for different teams to reflect their unique roles but keep the key facts and tone consistent. Avoid speculation or raising false hopes.

2. Understand and Mitigate the Impact

Every decision has ripple effects. It’s not enough to announce bad news; you need to show the team how you’ll address the challenges. At one company, we had to pivot prioritization due to a top-down change in priorities, impacting our OKRs. Instead of simply stating the change, we i. measured impact on OKRs, ii. outlined steps to reallocate resources, iii. outlined how we were going to hit our targets another way.

💡 What Worked:

Be upfront about the challenges.

Measuring impact

Share specific mitigation strategies to show how you’ll keep the team moving forward.

3. Set Actionable Next Steps

One of the most valuable lessons I learned was that clarity in next steps reduces confusion. During a strategy pivot at a previous company, we restructured roles and assigned clear owners for the new plan. This created a sense of direction and accountability, even amidst uncertainty.

🔑 Key Steps:

Assign ownership for each deliverable or task.

Use tracking tools to keep communication transparent and consistent.

Set milestones to measure progress and celebrate small wins.

4. Actively Listen and Keep Motivation High

A mistake I’ve seen—and experienced—is treating tough news as a one-way announcement. In one case, when we had to stop a product we've been working for a significant amount of time and shift to another one to increase time to market, we hosted a listening session with team members to hear their thoughts and ideas. That process not only helped morale but also brought up ideas for how to transition resources effectively.

💬 What Worked:

Hosting open forums and Q&A sessions.

Following up on feedback to show employees their voices were valued.

Recognizing contributions and ensuring people knew their roles were secure.

5. Communicate Transparently and Early

At one company, a delay in sharing big news led to rumors, which hurt team morale. From then on, I committed to being transparent, even when the details weren’t fully formed. People appreciated hearing updates directly from leadership rather than through the grapevine.

💡 Pro Tip: Overcommunicate. Deliver news in person or through a live meeting whenever possible. Avoid impersonal methods like email or Slack for significant updates.

Why It Matters

How you handle challenging updates reflects your leadership. Clear and empathetic communication:

Reduces anxiety: Employees feel informed and less likely to speculate.

Builds trust: Teams respect honesty, even when the news is tough.

Encourages collaboration: Transparency empowers employees to work toward solutions instead of feeling sidelined.

Key Takeaways

Prepare your message: Align on the facts, impacts, and mitigation plans before sharing.

Focus on solutions: Don’t just deliver bad news—show how you’ll overcome the challenges together.

Empower your team: Set clear next steps and listen to concerns to keep morale strong.

Be transparent and empathetic: Honesty delivered with care will always resonate.

Why Now Is the Time to Reconsider Your Approach

In times of uncertainty, your ability to communicate effectively can be the difference between maintaining a motivated team and losing their trust. Whether it’s strategy changes, setbacks, or other challenges, delivering news with empathy, transparency, and action builds a resilient and collaborative workplace.

Have you experienced a communication challenge? Let me know in the comments—I’d love to hear your perspective!

Top LatAm Fintech News and Insights from the past week

TL;DR (Too Long, Difficult to Read)

Here’s your quick dive into the key fintech trends from this week’s headlines:

1. Major Funding Rounds

Key Insights:

Embedded finance, BNPL, and employee wellness continue to attract significant funding across Latin America.

AI-powered tools and B2B solutions remain a major draw for investors.

Funding flows are enabling fintechs to expand regionally, with a strong focus on scalability and product innovation.

Examples:

🌎 R2 raises $9M equity and $50M debt facility: Funds will drive growth in LatAm, focusing on embedded lending infrastructure in Chile.

🚀 BV-backed fintech launches R$150M FIDC: Designed to support SME lending growth in Brazil.

🇨🇴 Addi secures $100M credit facility: Colombian BNPL startup expands its regional presence in LatAm.

🇲🇽 Minus raises $30M for financial wellness: Aims to help employees manage finances more effectively.

2. M&A and IPOs

Key Insights:

Mergers focus on enhancing platform capabilities, particularly in corporate mobility and credit offerings.

Share buyback announcements signal confidence in valuation among key players.

Examples:

🚀 Pluxee acquires Benefício Fácil: Strengthens corporate mobility solutions for SMEs in Brazil.

🔄 Stone announces R$2B share buyback: Reflects strong confidence in future growth prospects.

3. New Product Launches & Innovations

Key Insights:

Instant payments (PIX) and digital tools dominate product launches, signaling the growing demand for seamless payment solutions.

Partnerships are a key driver in expanding financial access for SMEs and consumers.

AI and automation continue to redefine financial services, especially in payment processing and user experience.

Examples:

💳 Fiserv automates PIX tap-to-pay for retailers: Streamlines onboarding for merchants to encourage adoption.

🇲🇽 Santander launches Openbank in Mexico: Marks a significant step for digital banking in the region.

🤖 Itaú tests WhatsApp AI for app enhancements: Focuses on conversational AI to improve user interaction.

🇧🇷 Cumbuca rolls out ‘Smart Pix’: Simplifies instant deposits, eliminating the need for manual key sharing.

4. Crypto & Blockchain News

Key Insights:

Regulatory clarity is accelerating crypto adoption, particularly for payments and trade finance.

CBDCs are gaining traction as a secure, efficient solution for financial transactions.

Examples:

🇧🇷 Brazil pilots blockchain-powered CBDC for trade finance: Enhances efficiency through partnerships with Microsoft, Chainlink, and Banco Inter.

🪙 Crypto payments expected to grow 200% by 2030: Adoption surges as innovation drives real-world use cases.

🇺🇾 Uruguay passes crypto regulation law: Pioneers regulatory clarity for digital assets in Latin America.

5. Regulatory Updates

Key Insights:

Compliance frameworks are becoming critical as fintech ecosystems grow more complex.

Licensing initiatives enable fintechs to enhance service offerings and meet regulatory standards.

Examples:

🏦 99Pay receives direct credit license: Strengthens its position as a leading digital financial service provider.

🌎 Nubank unifies Colombian operations: Streamlines services to enhance market presence and product efficiency.

6. Market Insights

Key Insights:

PIX adoption in Brazil is transforming payment habits, driving a significant shift away from cash.

Cybersecurity and consumer protection remain critical, with scams and data leaks raising concerns.

Gambling emerges as a competitor to traditional financial products like insurance and pensions.

Examples:

💳 Cash payments in Brazil drop 36% since PIX launch: Instant payments are reshaping consumer behavior.

🛡️ Black Friday scams cost Brazilians R$81M: Highlights the urgent need for stronger cybersecurity measures.

🔍 Smart PIX gains traction among fintechs: Automation in payments sees steady progress.

Overall Trends in LatAm Fintech

Funding Spotlight: Credit, embedded finance, and AI-led solutions dominate funding rounds, indicating a shift toward scalable and efficient fintech models.

Innovation Drive: Instant payments, PIX integrations, and AI-powered tools are addressing market demand for seamless financial solutions.

Regional Growth: Partnerships and licensing pave the way for cross-border expansion, particularly in underserved markets.

Regulation and Trust: Governments balance innovation with compliance, ensuring a secure ecosystem for growth.

The region’s fintech ecosystem continues to thrive, blending innovation with strategic growth and regulatory alignment.

Full News Breakdown

1. Major Funding Rounds

🌎 R2 raises $9M equity and $50M debt facility to expand embedded lending infrastructure: The funding will drive growth across LatAm, focusing on scaling operations in Chile and beyond

💰 Bertha Capital invests R$2M in Zemo Bank: The B2B fintech secures funding to accelerate product development and market expansio

🚀 BV-backed fintech launches R$150M FIDC to boost lending: The fund aims to expand the company's capacity to support SME growth.

🇨🇴 Colombian BNPL startup Addi secures $100M credit facility: Victory Park Capital provides funding to help Addi expand its lending services across Latin America.

🇲🇽 Minus raises $30M to promote financial wellness for employees: The Series B round was backed by Next Billion Capital, Flourish Ventures, and other key investors.

🇲🇽 Solvento secures $12.5M in Series A to streamline freight payments: The round, led by Cometa and joined by Quona Capital and others, will support the platform’s growth.

🇧🇷 Blip secures $60M to expand AI-powered customer communication tools: The funding, led by SoftBank and Microsoft, will support the Brazilian conversational platform’s growth.

2. M&A & IPOs

🚀 Pluxee acquires Benefício Fácil to expand corporate mobility portfolio: Pluxee signed a deal to purchase 100% of Benefício Fácil, a Brazilian provider of public transport solutions, aiming to enhance mobility benefits for SMEs.

🔄 Stone announces R$2B share buyback program: The move signals confidence in the company’s valuation and future prospects.

3. New Product Launches & Innovations

🇲🇽 Mendel launches tool to simplify corporate travel management: The platform adds online booking capabilities to enhance expense tracking.

🇲🇽 Albo and Paymentology team up to expand digital payments in Mexico: The partnership will provide 400 free top-up points for SMEs and retail clients nationwide.

🇨🇴 Nequi partners with CLINNG to boost real-time digital payments in Colombia: This collaboration allows CLINNG merchants to accept Nequi payments, promoting e-commerce growth across the region.

🇲🇽 Mendel introduces corporate booking tool for streamlined expense management: The LatAm startup enhances its suite of solutions with this feature to support businesses in managing travel and spending.

🚫 WhatsApp to end debit card payments by December: The messaging platform shifts focus to other payment methods in its financial services strategy.

☁️ C6 Bank adopts SAP cloud ERP for operations: The upgrade aims to boost operational efficiency and scalability.

💳 Fiserv automates PIX tap-to-pay setup for retailers: The innovation simplifies onboarding for merchants, encouraging adoption of digital payments.

📈 Fintech Upp grows 400%, earns $20M with accessible credit solutions: By focusing on affordable credit, Upp saw impressive growth, leveraging financial inclusion to drive results.

💡 C6 Bank reports R$2B profit and launches AI assistant: The bank's new AI tool aims to improve customer interactions and enhance service efficiency.

🔄 Ingenico tests new PIX payment method: The initiative aims to enhance transaction flexibility with innovative approaches to PIX-based retail payments.

🛍️ Banks and fintechs test installment PIX payments: With "guaranteed" installment PIX still pending regulation, financial institutions are piloting alternative methods to offer this feature

🇧🇷 Jeitto launches personal loan tied to insurance and plans new offerings: The Brazilian fintech introduced a loan bundled with credit insurance and aims to roll out installment PIX and secured loans next year

🔐 Mastercard works to eliminate passwords for payments: The initiative leverages biometrics and technology to enhance security and convenience

🔮 Itaú prepares PIX innovations for 2025: The bank is working on enhancing the instant payment experience with upcoming features

🤖 Itaú tests WhatsApp AI for app enhancements: The pilot aims to improve customer interactions through conversational technology.\

🇧🇷 PicPay launches Smart POS machine for businesses: The new device features an integrated camera, NFC support, Wi-Fi/mobile connectivity, and accepts cards, digital wallets, and Pix payments.

🇲🇽 Santander launches Openbank in Mexico: The Spanish bank introduces its digital platform to tap into the Mexican market.

🇧🇷 Cumbuca rolls out ‘Smart Pix’ to simplify instant deposits: Users can now transfer funds via Pix without manually copying keys or switching between apps.

🇧🇷 Brazil pilots NFC-enabled payments via Pix: The initiative aims to make instant transactions even simpler and more accessible.

4. Crypto & Blockchain News

🪙 Crypto payments to grow nearly 200% by 2030: The adoption of digital currencies for payments is expected to surge, driven by innovation and acceptance.

🇧🇷 Central Bank of Brazil pilots blockchain-powered CBDC for trade finance: In collaboration with Chainlink, Microsoft, Banco Inter, and others, this initiative aims to enhance trade finance efficiency.

🇺🇾 Uruguay passes crypto regulation law, setting LatAm precedent: The legislation grants the Central Bank authority over virtual assets, offering clear rules for the crypto ecosystem.

5. Regulatory Updates

🏦 99Pay receives license to operate as a direct credit society: The move strengthens its financial service offerings, positioning it as a robust digital account provider.

🌎 Nubank unifies Colombian operations to grow local portfolio: The strategy aims to streamline offerings and strengthen market presence.

6. Market Insights

💳 Brazil: Cash payments drop 36% since PIX launch: The use of cash in Brazil has decreased significantly, reflecting the rapid adoption of PIX for instant and digital payments.

🛡️ Brazilians lost R$81M to digital scams during Black Friday 2023: Fraudsters took advantage of the shopping event, emphasizing the need for stronger cybersecurity measures.

⚠️ Brazil? Bets rival insurance and pensions in popularity: The rise of gambling is reshaping consumer preferences, potentially disrupting financial markets.

🔓 PIX key data leaks cause concern for 2024: Reports highlight increased vulnerabilities, prompting calls for enhanced digital security.

🛑 Brazilian Banks halt offering INSS payroll loans: Regulatory and operational issues lead to the suspension of this key lending product for retirees.

📈 Nearly all Brazilians have a primary bank, but only 10% are exclusive: The report reveals opportunities for banks to deepen customer relationships. (Finsiders Brasil)

🔍 Smart PIX (Pix and Open Finance merge to automate payments) gains tractionamong three fintechs, Mercado Pago, Cumbuca and Noh. Despite progress, the journey to fully integrated smart payment solutions is far from over.

🏦 Brazil: Delisting offers rise as firms exit stock markets: An increase in privatizations signals shifting priorities among public companies

📊 Combined profits of Inter, Nubank, PagBank, Stone, and XP grow 46%: The major fintech players showcase strong performance in the financial sector

🌎 Nubank considers relocating its legal base to the UK: This move signals its focus on aligning with regulatory standards and deepening its market presence.

🌎 David Vélez, Nubank founder, wins Forbes 2024 Excellence Award: Recognized for his transformative contributions to LatAm's financial sector.

🌎 Nubank named Bank of the Year by LatinFinance: The award highlights the digital bank’s influence and innovation in financial services.

That’s All for Today!

Thanks for catching up on the highlights from the last week. Which stories or insights resonated with you the most? I’d love to hear your thoughts— comment, shoot me a note, or connect with me on LinkedIn!

Stay focused, stay bold, and keep building. 🚀

Until next time,

Edu