Brazilian Fintechs are Breaking Even, PMs should own P&Ls, and more

Brazilian Fintechs are Breaking Even,Product Managers should be embracing P&L Ownership , and the latest fintech news in Latin America.

‘‘The goal of a startup is to figure out the right thing to build—the thing customers want and will pay for—as quickly as possible.”

― Eric Ries, The Lean Startup

Hi Fintech Enthusiasts, Founders, and Product Leaders. Today we’ll go through Brazilian Fintehs breaking even, why PMs should own P&Ls, and all the exciting LatAm news you need to know about.

Brazilian Fintechs are Breaking Even

5 years ago, everybody was focused on growth. Huge marketing spend, high CAC, as long as you brought in the millions was all that mattered to raise a big round. Some valuation multiples were making the rule of thumbs of 1 million customers = USD 1Bn.

Fortunately, the market corrected and we now have a generation of healthy, sustainable startups, providing long-term value to customers and investors.

Big Companies Leading the Way

The financial robustness of Brazil's fintech sector is exemplified by several major players who have posted impressive profits in 2023. Here’s a ranked breakdown of their earnings:

Nubank: Leading with over $1 billion in profits, setting a high standard for scalability and profitability in the sector.

XP: Achieved $780 million, demonstrating strong investment management and brokerage services performance.

PagBank: Reported $360 million, reflecting its success in providing digital banking and payment solutions.

Stone: Earned $320 million, known for its payment processing services tailored primarily for small and medium-sized businesses.

Banco Pan: With $155 million, focusing on consumer lending and banking services.

Banco Inter: Garnered $70 million, offering a full suite of digital banking services including investments and insurance.

Brazilian B2B Fintechs are following the break-even trend

PicPay, a fintech giant with over 50m customers, and Swap a B2B infrastructure fintech also achieved break-even last year, though Swap has still to prove a full year of profitability.

The trend of financial achievement extends further with ContaSimples and Starkbank. ContaSimples, which reached break-even, raised a significant investment of $40 million in early 2024 to further solidify its market position. Starkbank, specializing in business financial services, reported $15 million in profits for 2023, marking it as another success story.

Adding to this list, Conta Azul, a well-established Brazilian fintech and ERP system provider, is making significant inroads into the B2B fintech space. With plans to expand its financial services, Conta Azul is poised to leverage its existing capabilities to offer more comprehensive solutions to businesses across Brazil.

Alongside Conta Azul, Asaas—a fintech offering a corporate account with payment management and ERP for small and medium-sized enterprises—has been generating positive cash flow for years without the need to raise external funds to sustain its operations. This financial independence highlights Asaas’s robust business model and operational success in the fintech landscape.

These achievements highlight a broader trend within Brazil's fintech sector, where companies are not just surviving but thriving by focusing on innovative financial solutions, efficient service delivery, and sustainable business practices. Their success serves as a beacon for potential investors and a testament to the growing maturity of the fintech market in Brazil.

As these companies continue to reach and surpass the break-even point, the future looks promising for the Brazilian fintech ecosystem. This progress is crucial not only for the companies involved but also for the broader economic landscape, demonstrating that innovation paired with strategic financial management can lead to remarkable outcomes.

🌶 Hot-take:

Owning a share of business profitability from the outset not only simplifies product decision-making but also justifies a product leader's role in an era where tech companies are aggressively cutting costs.

This financial stewardship is crucial for aligning product strategies with company-wide financial health and ensuring the sustainability of one's position within the organization.

🚨The challenge: The product Team's KRs are not always P&L-related

Product teams are often tasked with specific KPIs like retention or growth, which do not always directly correlate with immediate profitability. Yet, our work is crucial in contributing to the broader P&L managed by the CEO. As product managers, we must navigate our roles with precision and align closely with corporate objectives. A good example is areas such as internal tools, where the impact on profitability may be less direct yet still vital.

🏋🏻♀️ Product Owner is not enough

The recent industry-wide layoffs have flooded the market with talented product managers, raising the bar for everyone. Today, being a product owner is insufficient; one must be a strategic partner who actively contributes to the business's bottom line. We should be systems thinkers, balancing user needs with business viability to deliver real value.

🤝Make the finance team your ally

I've always worked alongside finance teams in all companies I've worked with. This ensures that each product initiative not only solves customer problems but also enhances the company's financial position. It's also key to ensure that as a Product Manager, you provide realistic expectations on the outcomes your features will bring to the business.

🧠 Wrapping it up

Our role as product managers is evolving from mere guardianship of product development to being pivotal in financial strategy and execution. This shift requires a deep understanding of both market demands and the financial implications of product decisions.

The successful product manager of today can justify their strategic decisions and their role, ensuring their contributions are both impactful and aligned with the overarching goals of their organization.

What are your thoughts on owning P&L responsibilities? Have you faced this in the past?

🗞️Fintech News and Bites

🌎 Nubank announces a hefty investment of $100 million in Mexico, elevating its total regional investment to $1.4 billion.

📲 Nubank is gearing up to launch its own mobile carrier in Brazil, using Claro's network. This move is backed by Anatel's approval, leveraging Nubank’s prominence as a major sales channel for mobile recharges in Brazil.

🔄 Nubank will phase out the NuInvest app and centralize its investment services to streamline and enhance the investment process for clients.

🔔 Nubank introduces the Verified Call feature, confirming the authenticity of company calls to safeguard customer security.

🌍 Nubank has struck a deal with Wise to dive into the competitive global account market, catering to the high-income UltraVioleta clients with offerings that include a virtual chip with 10GB of internet for travel abroad, cost-effective transfer rates, a global account, an international debit card, and no-fee international withdrawals.

💰 The US government’s Development Finance Corporation (DFC) has approved a $150 million loan to Nubank to propel its expansion in Colombia, part of a new financing package for businesses in developing nations.

🏢 WohPag, a Brazilian fintech catering to condominiums, has entered the anticipatory receivables market.

💳 Itaú now enables installment payments via Pix for small and medium enterprises, allowing entrepreneurs to maintain their credit card limits. The minimum transaction amount is set at R$1,000, with varying credit conditions and fees based on the client's profile.

📈 SulAmérica has successfully managed R$70 billion, riding the wave of fixed-income investments.

👤 Mercado Livre plans to hire 6,500 individuals in Brazil, expanding its total direct workforce to over 29,000 by the end of 2024.

🔀 Mercado Pago is set to introduce a new Open Finance feature enabling smart transfers.

📉 Banco Brasileiro C6 has significantly reduced its losses by 65% to $865 million in 2023.

📊 Cryptocurrency transactions and active user numbers in Latin America have surged by 61%, with transaction numbers increasing by more than 105% year-over-year.

🔗 Starting this Monday (15), Brazilian Open Finance will enhance its functionalities, including smart transfers, to boost system adoption through automated Pix transfers between accounts.

🏦 Banco Carrefour has broadened its service offerings to include personal credit limits for Sam’s Club cardholders, alongside insurance to protect against unauthorized Pix transactions.

🌐 Toku, a Chilean fintech specializing in recurring payments, is expanding its operations to Brazil with an investment of about R$10 million.

⭐️ Credicuotas unveils a new card powered by Pomelo in Argentina to broaden credit access.

🌟 Dapta secures US$1.2M to boost SMEs with artificial intelligence.

🏦 Revolut obtains a banking license in Mexico, marking a significant step in its expansion efforts.

🚧 Uber temporarily suspends its fintech initiatives in Mexico due to increased competition from rivals DiDi and inDrive in financial services.

🌎 Neobank Inter&Co targets the Brazilian diaspora to fuel its growth in the US, focusing on strategic international expansion.

👛 Picpay celebrates its first annual profit and now serves 35 million active users.

🛠️ Brazilian B2B credit FinTech CashU raises US$1.4M to scale up its operations across the region.

🔍 Brazil's Central Bank rolls out features to combat fraud using Pix aliases.

💸 Open Finance in Brazil could save over 60% of 'rejected' loans, as shown in recent trials.

✅ FinTech Fiado is now an authorized Electronic Payment Funds Institution in Mexico.

📡 FinTech Radar secures a US$1.5M investment to broaden its footprint in Mexico.

🤝 FinTech Palenca and Experian partner to provide income verification services in Brazil and Colombia.

📊 Swap, a Brazilian B2B fintech specializing in payment processing and financial infrastructure, has achieved break-even status. Profits emerged in December and have sustained through the first quarter of this year.

💵 The Brazilian BNPL FinTech company Koin has raised $7.3 million to enhance its service offerings for the anticipation of receivables for retailers in the tourism sector.

🚜 goFlux, a Brazilian agro-financing and digitalization company, has raised $6 million in a Series A round led by Capria Ventures with participation from SP Ventures.

🤖 Kamina, an Ecuadorian AI-based financial prevention platform, has raised $3.2 million in a Pre-Seed round and plans to expand operations to Mexico, Peru, Colombia, and Chile.

💼 EmpreX, a Brazilian open finance platform tailored for the middle class, has received a $7.65 million investment from SRM Ventures.

💳 Stark Bank, a Brazilian B2B neobank, is expanding its services to include virtual transaction acquiring.

🌟 Finaktiva, a Colombian SME financing ecosystem, introduces a new platform for centralized financial management.

🏦 Klar, a Mexican digital bank, announces a new feature for personal loans up to US$6,000, catering to individual financial needs with fixed interest rates and flexible repayment terms.

💾 tbDEX launches in Brazil, a decentralized payment system by TBD, facilitating international transfers and adopting self-sovereign identity to address trust and compliance in cross-border transactions.

🔗 Konvex, a Colombian API software for reconciliation and underwriting, launches a universal API to streamline SME operations by integrating more than 10 ERP systems into a single interface.

📈 B3, the Brazilian financial market infrastructure company, unveils a tokenized asset solution for crowdfunding platforms, aiding startups in fundraising and trading in secondary markets, supported by Kria and EqSeed.

🔑 Findo, an Argentinian company, introduces an AI-powered credit scoring system for underserved communities, aiming to enhance financial inclusion by evaluating over 170 parameters to determine creditworthiness.

🏦 Littio, a Colombian financial platform for emerging economies, announces a US bank account offering for Colombians, linking them to the US banking network.

Other Product, Fintech, and Strategy Reads

🎯10 steps to excel in turning strategic visions into actionable outcomes

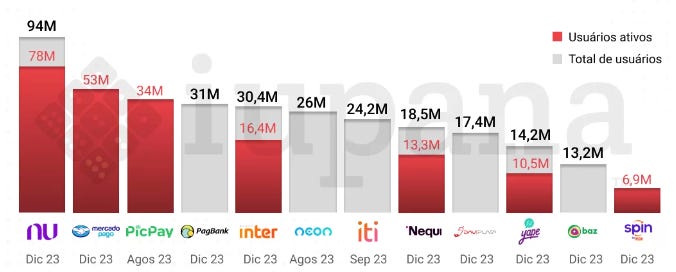

The most used Digital Wallets in LatAm

That was all! ✌🏼

Thank you for reading my newsletter! If you enjoyed it, please subscribe and share it with your friends and colleagues.

Un Abrazo,

Edu